Authorisation processes and access rights mean you can control the level of access per user to suit your business needs. Most used ways are as follows.

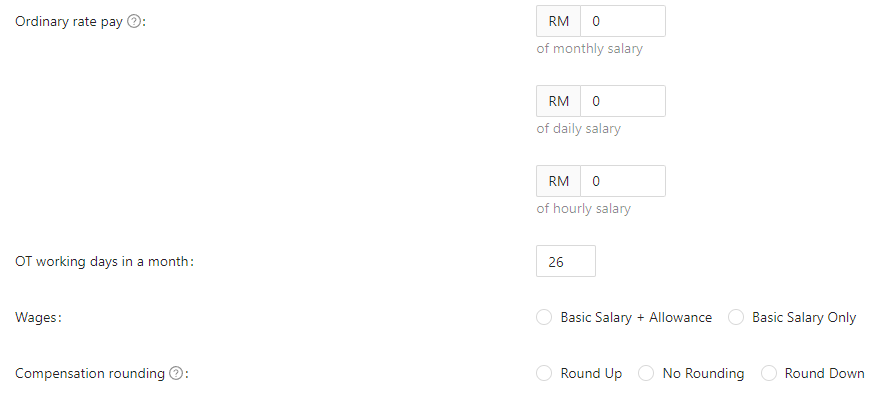

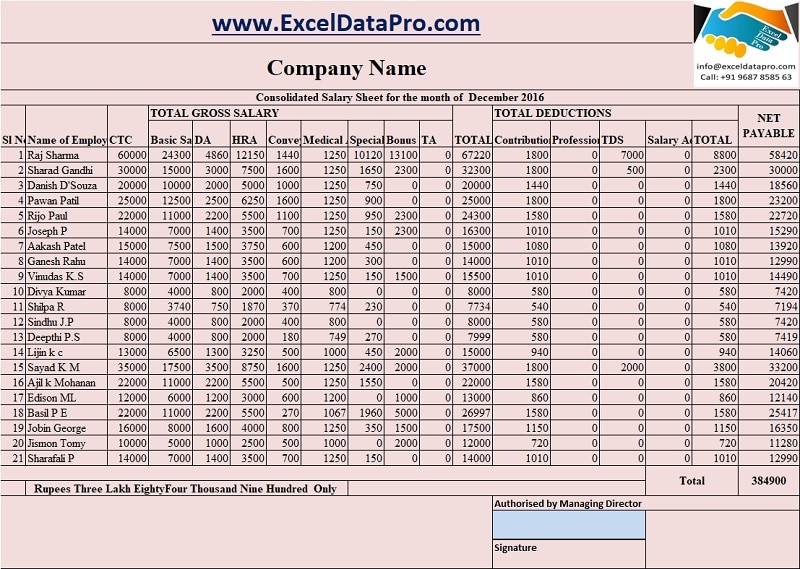

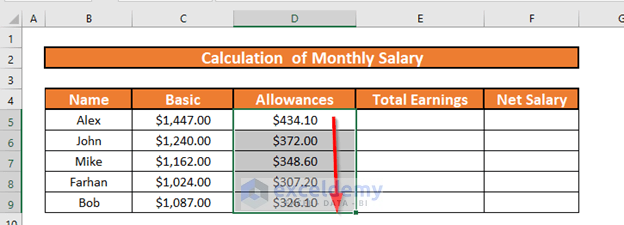

How To Create A Monthly Salary Sheet Format In Excel With Easy Steps

For a non-resident employee in Malaysia the net PCB should be 28 of his or her salary.

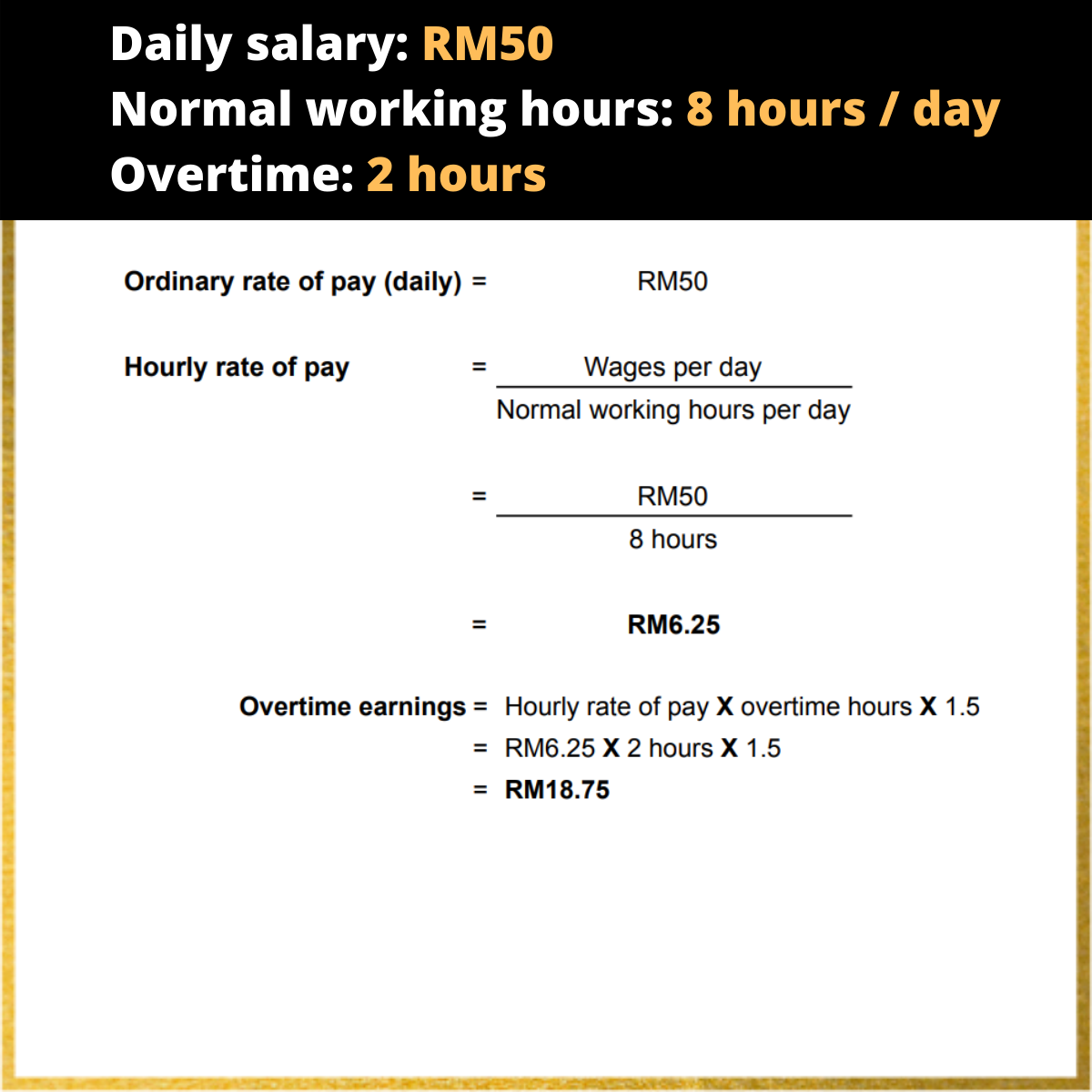

. Contractors can typically demand a higher salary - the figure is roughly reported as being 15 more in comparison to a permanent employee. Explore real-world career trends and advice from the leaders in compensation. Working Hours per Day 8 hours.

Monitor the current months average daily balance to calculate your overall bonus interests. EIS contributions are capped at a salary or gaji of RM4000 each month. 70 x 8 hours 56 hours or 5 hours and 36 minutes account to total 33 hours 36 minutes per week and part time staff cannot exceed this limit if heshe to be considered as part time employee.

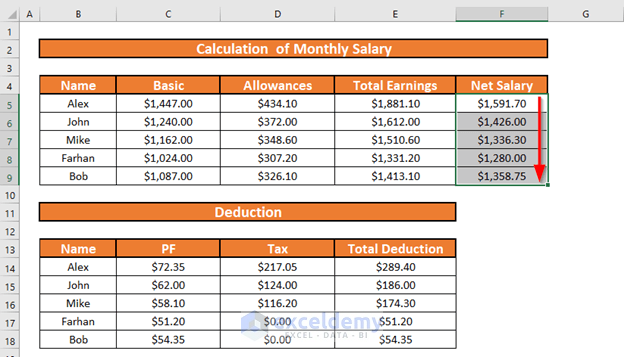

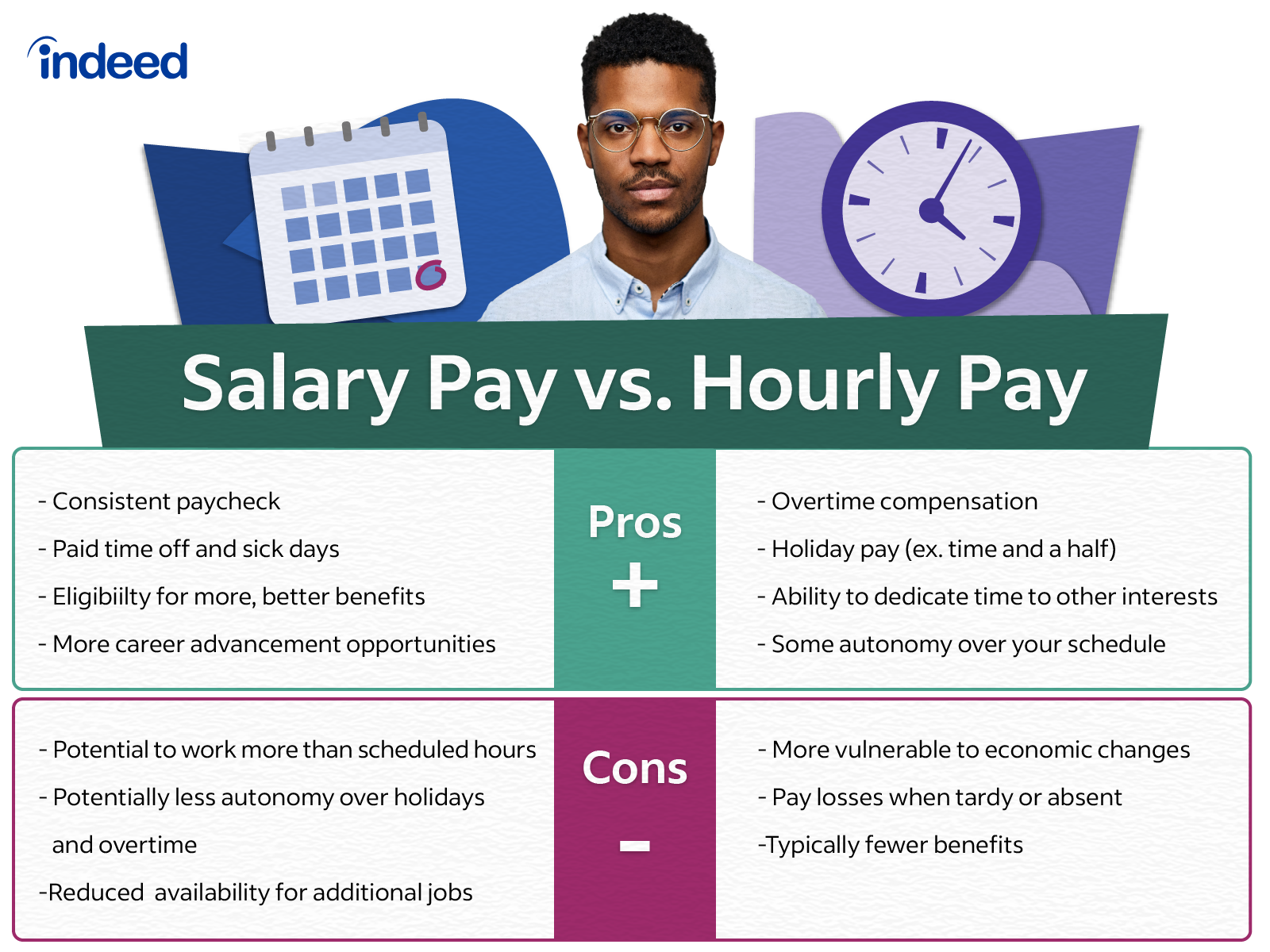

Overtime Pay Overtime Hourly Rate Overtime. RM1895 4 RM75. Rs 25 Total late fees to be paid per day.

Net PCB RM 500000 x 28. For employers on the other hand it allows a real-time HR system for monitoring. The local qualifying salary LQS determines the number of local employees who can.

Multiple transactions at a time. Central Goods and Services Act 2017. Calculate and submit VAT to HMRC.

No duplication of effort giving you more time to focus on what matters most your business. 1 1 day basic salary X no. There are two ways to calculate PCB - the computerised method and the non-computerised calculation.

Input your last working date. 44783 x 115 515 daily contractor. His EIS contribution would be capped at a salary of RM4000.

A person gets a salary of Rs12000 per month and allowed leave days per month is 2. 8 hours per day x 6 days week 48 hours per week for normal full time staff. Use a private browsing window to sign in.

Total leave hours for a certain leave category divided by the number of hours in a day worked by the employee. Yusri earns RM7000 per month. This means the actual EIS contribution amount is capped at RM790 from employers and RM790 from employees.

Input the number of payable days per year minimum of three weeks or 21 days as per the law. Make all your salary and supplier payments securely directly from your accounting or payroll software and benefit from a fully digital experience with the electronic payment. Input the starting date of your work as stated in your contract.

Name of the Act Late fees for every day of delay. Click Calculate the button on the bottom part. How is last day calculated in Malaysia.

How to calculate your end of service gratuity. If the notice period is not provided the employer needs to give the payment in lieu of notice. MSc Statistics vs MSc Mathematics MSc Statistics is a study of the collection organization and interpretation of data and MSc Mathematics degree provides in-depth knowledge to the students in advanced applied mathematics and prepares.

Can calculate hourly daily and monthly salary. Quotes Estimates 09022021 From 09022022 To Calculate Refresh summary DUE 50 25 14 11 44 OVERDUE 56 Outstanding Sales Invoices Salary 95890 95890 Total Payments 95890 Payment PAYE 6042 National Insurance 3488 Company Pension 3790. Total cap for both is RM1580.

RM1250 15 RM1875. 1 local employee 1 LQS count if they earn the LQS of at least 1400 per month. With this best payroll software in Malaysia employees can also log in conveniently using a mobile attendance app.

For example if you give the notice on July 6 then his last day should fall on September 5. You must credit your salary of at least S1800 per month to your OCBC 360 Account and make at least 5 qualifying retail transactions in 2 months on your OCBC 365 Credit Card. Rs 50 The law has fixed a maximum late fees of Rs 10000 up to May 2021.

PCB is still deducted as per normal from hisher monthly salary. Monthly Salary RM2600. Input your basic monthly salary as stated in your contract.

The termination date is calculated from the day you give the notice and the day before the same day of the next month. Calculate the 20-year net ROI for US-based colleges Career Advice. 05 local employee 05 LQS count if they earn half the LQS of at least 700 to.

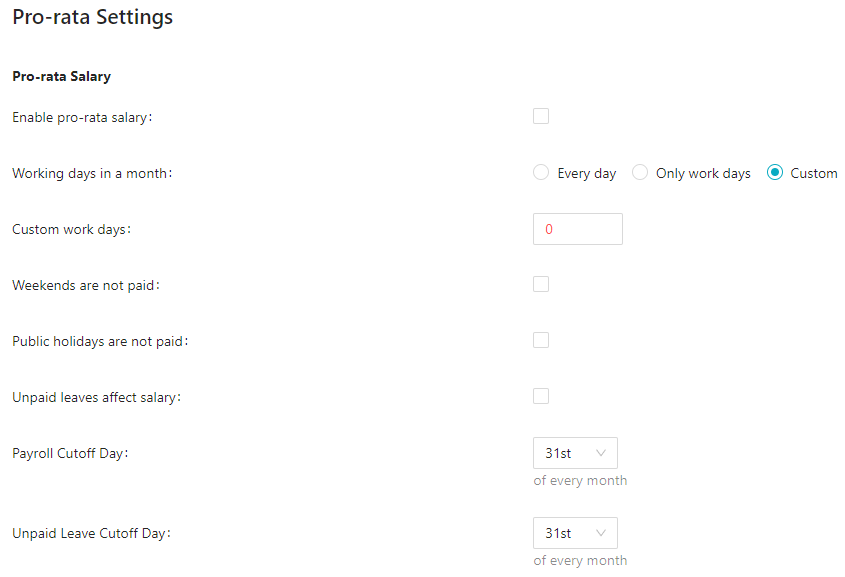

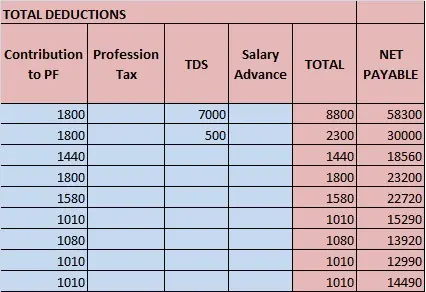

On average contractors will work 230 days in a year. Normal Hourly Rate Monthly Salary Working Days per Month Working Hours per Day RM2600 26 8 RM1250 Overtime Hourly Rate Normal Hourly Rate 15. 2 1 day basic salary 1 day TA 1 day DA X no.

Overtime 4 hours. Your local workforce is updated on the second working day and. Funds received on a non-business day for example.

New online salary profiles per month. Total monthly remuneration RM 500000. The last date for paying wages is 7th if the following month.

So you divide the total of your permanent salary monetary equivalent of benefits by those 230 days. Different companies calculate it in different way. Using the above example if an employee works 6 hours per day and has a total leave balance of 32 hours the conversion from.

Leave encashment calculation formula. The starting salary ranges between INR 300000 to INR 700000 depending on the skills of the candidates. Calculate Leave Encashment Payment.

Rs 25 Respective State Goods and Services Act 2017 or Union territory Goods and Services Act 2017.

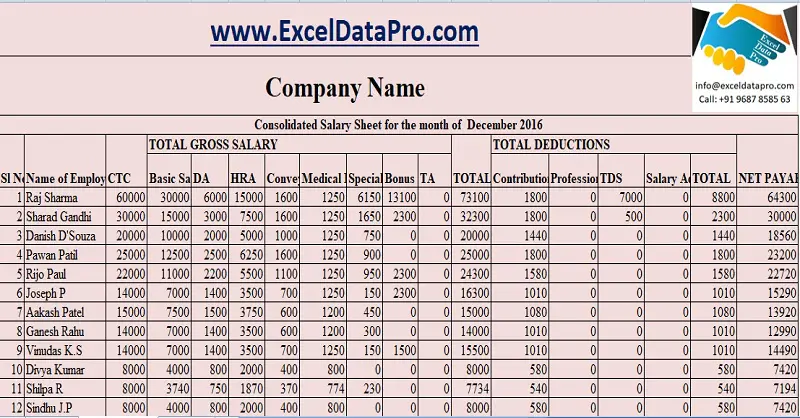

Download Salary Sheet Excel Template Exceldatapro

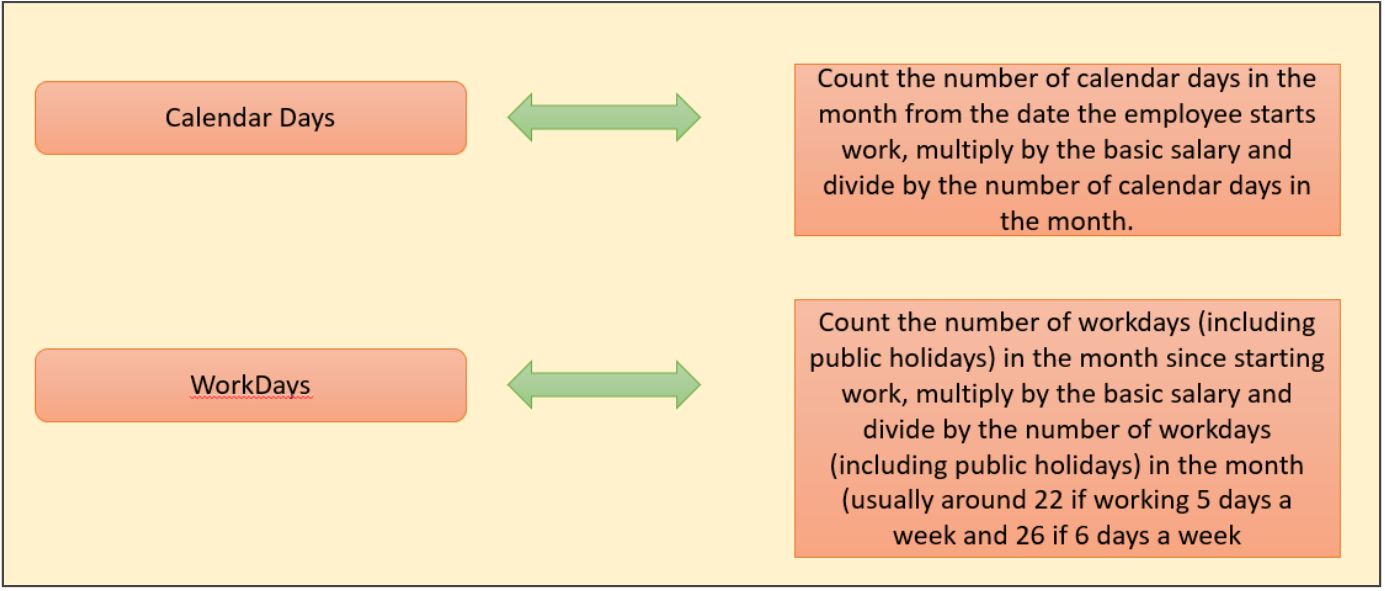

Salary Calculation Dna Hr Capital Sdn Bhd

Download Salary Sheet Excel Template Exceldatapro

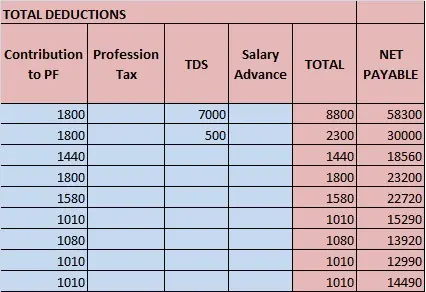

Differences Between Wages Vs Salaries Plus Pros And Cons Indeed Com

How To Calculate Overtime Pay For Employees In Malaysia Althr Blog

Salary Slip Format In Excel Payroll Payroll Template Excel Templates

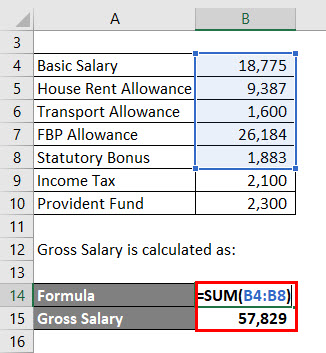

Salary Formula Calculate Salary Calculator Excel Template

How To Create A Monthly Salary Sheet Format In Excel With Easy Steps

Everything You Need To Know About Running Payroll In Malaysia

Salary Formula Calculate Salary Calculator Excel Template

Download Salary Sheet Excel Template Exceldatapro

Salary Formula Calculate Salary Calculator Excel Template

.png)

All About Basic Salary Wage In Malaysia

Malaysia S New Minimum Wage To Take Effect From 1 May 2022 What Employers Should Note

Salary Formula Calculate Salary Calculator Excel Template